NEW YORK, Dec 19 (Reuters) —

Shippers, consumers, railroad workers, and local communities are raising alarms after railroad operators Union Pacific and Norfolk Southern filed a nearly 7,000-page merger application with the U.S. Surface Transportation Board (STB). The proposed $85 billion deal would create the nation’s first coast-to-coast freight railroad, dramatically reshaping how goods move across the United States.

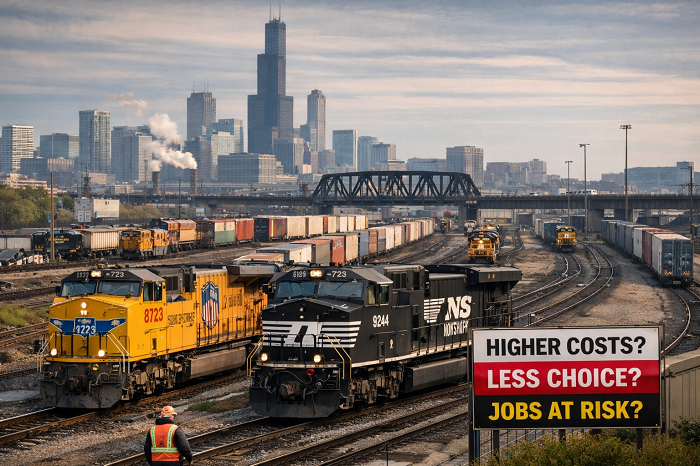

If approved, the merger would reduce competition in an already concentrated industry, leaving customers and businesses with fewer transportation options and potentially higher shipping costs. Remaining freight rail users fear they would be forced to rely on a dominant transcontinental carrier with significant pricing power.

The filing triggered a 30-day review period during which the STB may request more information or propose initial remedies. It also opened a formal window for affected stakeholders — including shippers, labor unions, consumer advocates, and local officials — to submit objections or seek conditions to protect the public interest.

The proposal, first announced in July, surprised analysts who said such consolidation would have faced tougher resistance under earlier administrations. While the deal received public support from President Donald Trump, market participants and consumers argue that political backing does not eliminate the economic risks tied to reduced competition.

OPPOSITION FROM AFFECTED COMPETITORS AND CUSTOMERS

Strong opposition has emerged from competing railroads and their customers, who warn that the merger would deepen market concentration. Currently, four Class I freight railroads dominate the U.S. market, with Union Pacific and BNSF controlling most western routes and Norfolk Southern and CSX operating primarily in the East.

Union Pacific and Norfolk Southern claim the merger would eliminate costly East-West handoffs, particularly in Chicago, improving efficiency. However, shippers argue that efficiency gains may come at the expense of choice, bargaining power, and fair pricing.

BNSF, owned by Berkshire Hathaway, warned that the deal would significantly reduce shipper options and lead to higher rates. Its CEO said the merger poses a serious long-term threat to the U.S. economy and American consumers, citing potential competitive harm.

Canadian Pacific Kansas City (CPKC) echoed these concerns, stating that the merger presents extraordinary and far-reaching risks to customers and would undermine competition across North America. The company said it will actively participate in the regulatory process to oppose the deal.

CSX, another major railroad previously unable to secure a merger, said it is reviewing the filing and will engage in the STB process to protect its ability to compete — a move seen as critical to safeguarding customers and regional markets.

Industry analysts warn that unless strong conditions are imposed, rail customers and communities could face a wave of defensive mergers, further shrinking competition. The deal is the first major railroad merger to be reviewed under the stricter STB framework adopted in 2001, which requires proof that a merger enhances — not merely preserves — competition and delivers clear public-interest benefits.

For now, shippers, consumers, and workers say the approval of this merger is far from inevitable — and that the stakes for the U.S. economy and supply chain resilience could not be higher.